Many believe shorter home loan tenures cut interest costs—but that’s only half the story.

In this article, I’ll explain why choosing the maximum tenure—typically 30 years, with repayment possible until age 60–80 depending on lender policy—can often be the smarter move, while also addressing common misconceptions.

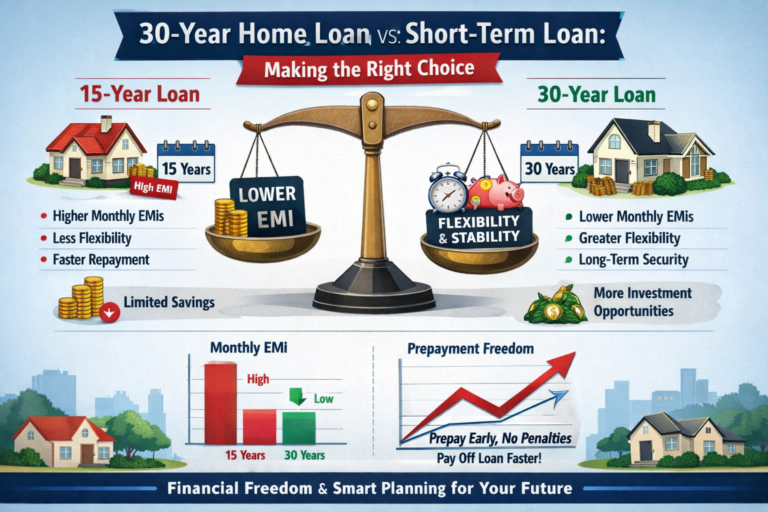

Why a 30-Year Tenure Can Be Beneficial

- Lowest-cost borrowing option

Home loans are the most affordable credit option—borrowers with CIBIL 800+ can get rates as low as 7.10%. - Repo-linked advantage

Home loans stay affordable thanks to RBI’s repo rate—backed by the government’s push for jobs and housing for all. - Lower EMIs, higher eligibility

A longer tenure reduces monthly EMI commitments, making it easier to qualify for higher loan amounts. Since exceptional income growth is rare in the short term, keeping EMIs manageable is a practical strategy. - Financial resilience during uncertainties

Life is unpredictable—pandemics, medical emergencies, or business setbacks can occur. Lower EMIs help you meet obligations comfortably, maintain a healthy CIBIL score, and stay eligible for future loans at competitive rates. - Opportunity to invest elsewhere

Reduced EMI pressure allows you to invest in better opportunities, helping secure your family’s financial future.

Addressing the Misconception: Higher Tenure = Higher Interest

It’s true that a longer tenure increases total interest if you strictly follow the EMI schedule. However, this concern is outdated. Since RBI’s June 2012 guidelines, banks and NBFCs do not charge prepayment penalties on floating-rate home loans.

This means you can take a 30-year loan and prepay it in 15 years—or even earlier—without extra charges. By setting up a simple standing instruction (SI) from your savings account to your loan account, you can speed up repayment at your convenience. This way, you get the flexibility of a long tenure without paying more than a shorter one.

Final Thoughts

Financial planning is never one-size-fits-all. The right home loan tenure depends on income stability, risk appetite, and long-term goals. A 30-year home loan offers flexibility, resilience, and investment freedom, while still allowing early repayment if desired.

If you’d like to explore what works best for your situation, feel free to book a free consultation session with me.