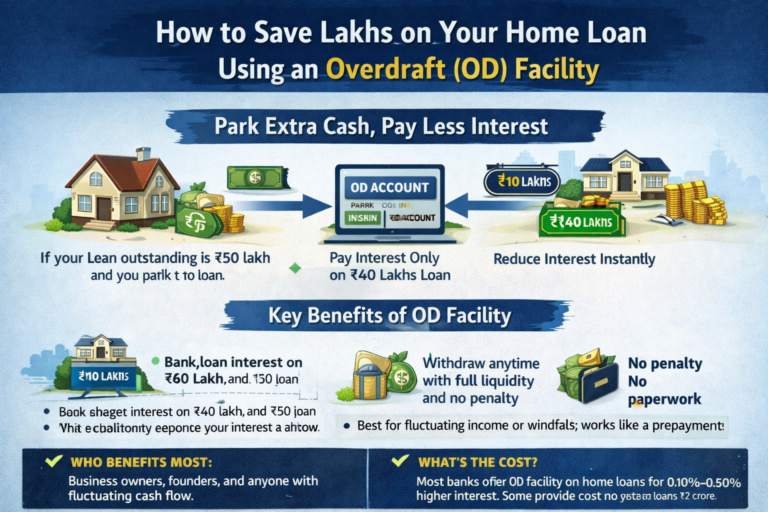

It’s simple:

Whatever extra money you park in the OD account reduces your interest immediately — without locking your funds.

1. Interest is charged only on the net outstanding

If your loan outstanding is ₹50 lakh and you park ₹10 lakh in the OD account:

- Bank charges interest on ₹40 lakh, not ₹50 lakh

- This significantly reduces your interest outflow

- Even short-term deposits (2–3 days) help save interest

2. Every rupee parked works like a prepayment, but stays liquid

Unlike normal prepayment, an OD account offers:

- Full liquidity — withdraw anytime

- No penalty

- No paperwork

Who Benefits the Most

This facility is ideal for business owners, founders, and individuals with fluctuating cash flow. Bonuses, business income, rent, or surplus savings can be parked to reduce interest instantly.

What’s the Cost?

Most government banks and some private banks offer this facility at a slightly higher interest rate (around 0.10%–0.50% extra).

However, a few government banks provide OD facilities on home loans up to ₹2 crore without any additional interest rate or charges.

Bank of Baroda and Bank of India are two such examples.